Micron Non-Volatile Update (Q2'18): 96L 3D NAND in H2, 4th Gen 3D NAND Enroute, Sales of 3D XPoint Disappoint

by Anton Shilov on June 22, 2018 12:00 PM EST

Micron this week published its financial results for the third quarter of its fiscal 2018 (ended on May 31), which also included an update concerning its non-volatile memory products and projects. The company confirmed that it is on track to start volume shipments of 96-layer 3D NAND chips (3rd Gen 3D NAND) in the second half of calendar 2018, and said that development of its 4th Gen 3D NAND is proceeding as planned without participation of Intel. At the same time, Micron indicated that sales of its 3D XPoint memory were well below expectations, which hurt the company financially because its fab remained underutilized.

64-Layer 3D NAND Progressing Well, 96-Layer Is On Track

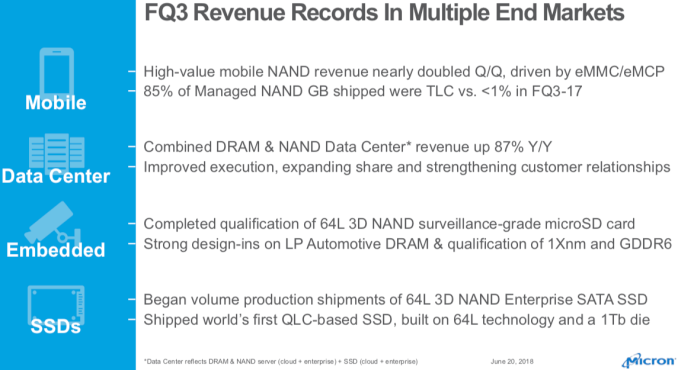

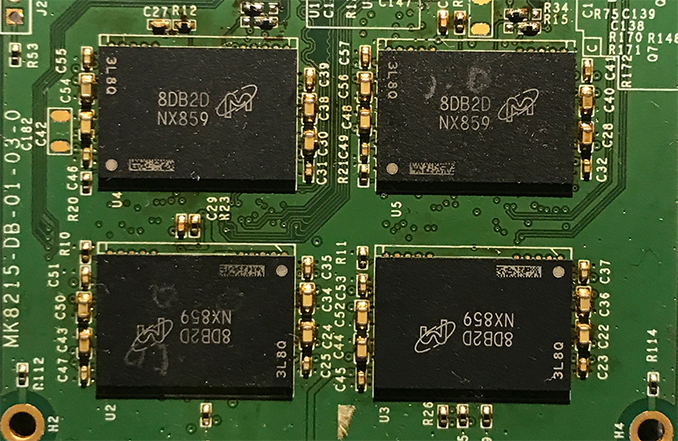

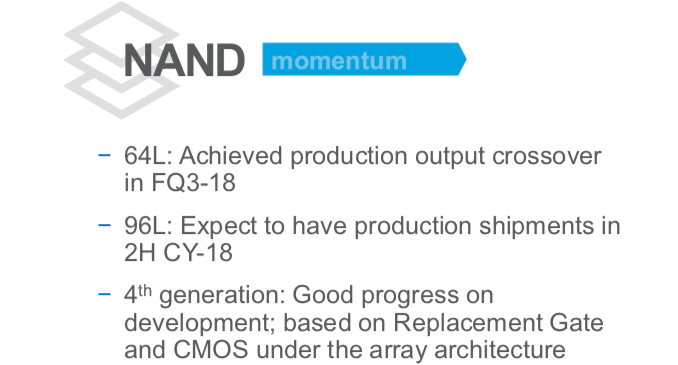

At present Micron is ramping up production of its 64-layer 3D TLC NAND memory (2nd Gen 3D NAND) and last quarter it achieved production output crossover with other types of NAND the company manufactures. This is particularly good news for Micron because 64-layer 3D NAND devices are significantly more cost-efficient in terms of cost per bit compared to 32-layer 3D NAND memory, which allows Micron to earn more. In fact, 64-layer 3D NAND enabled Micron to launch two major products. First, the company released its 2.5-inch SATA 5200 ECO SSDs with up to 7.68 TB capacity in January targeting mainstream servers. Second, 64-layer 3D QLC memory enabled Micron to compete for nearline storage segment with its 5210 ION drives launched back in May.

Earlier this month we reported that at least two developers of SSD controllers have qualified Micron’s 96-layer 3D TLC NAND memory for SSDs. During the conference call, Micron confirmed that it was on track to ship its 3rd Gen 3D NAND in volumes for commercial products in the second half of calendar 2018. It is not clear whether the initial batches of such memory will be used for various removable storage solutions (memory cards, USB flash drives, etc.) as it happens usually, but it is evident that Micron’s 96-layer 3D NAND is making a good progress with designers of SSD controllers. Maxio Technology intends to use Micron’s 3D TLC B27A memory for inexpensive drives based on its MAS0902A-B2C DRAM-less controller, whereas Silicon Motion is so confident of this memory that it has qualified it with its top-of-the-range SM2262EN controller for high-performance SSDs.

“We still expect to have production shipments on our 96-layer 3D NAND in the second half of calendar year 2018,” said Sanjay Mehrotra, CEO of Micron.

Micron’s 4th Gen 3D NAND to Use Replacement Gate

Moving on, we have Micron’s 4th Gen 3D NAND, which is developed solely by Micron without any input from Intel. Since the tech is set to hit production in the coming quarters, its development is well underway at this point. According to CEO of Micron, development of the company’s 3D NAND memory with more than 96 active layers (e.g., 128 layers, or more) is progressing well.

Meanwhile, the only thing that the company discloses about its 4th Gen 3D NAND right now is that it will keep using the CMOS under the array architecture that enabled IMFT to build the smallest 3D NAND memory devices in the industry, as well as the “novel replacement gate” technology.

“We are also making good progress on the development of our fourth-generation 3D NAND, which will utilize our novel replacement gate technology,” said Mr. Mehrotra.

Samsung has used its gate replacement process for its V-NAND for years now, but Samsung uses the technique alongside its charge trap cells. By contrast, IMFT has used its floating gate technology for 3D NAND, something that other makers decided not to do. It is unclear whether adoption of gate replacement means that Micron will move on to charge trap (like the rest of the industry, including Samsung, SK Hynix, and Toshiba/Western Digital), or will keep using floating gates. Technology experts from Imec recently predicted that Micron will eventually have to move from floating gates based on polysilicon-oxide stack to charge trap cells based on oxide-nitride, but Micron yet has to confirm this itself.

Micron did not have to use string stacking technique for its commercial 64-layer 3D NAND, even though it reportedly demonstrated a 64-layer 3D NAND chip by stringing two 32-layer devices together a couple of years ago. Meanwhile chances are that it will have to use the technique with its subsequent generations of 3D NAND — produce a full 3D NAND stack, form the channel, add an insulating layer, then build a new 3D NAND stack on top. The big question is whether string stacking is set to be used for 96-layer, 128-layer, or even more complex 3D NAND devices; but it is evident that 3D NAND manufacturing is getting more complex as the number of layers increases.

Sales of 3D XPoint Disappoint

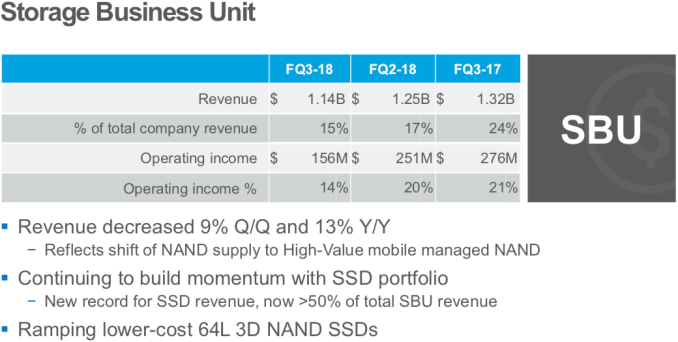

While sales of Micron’s SSDs are growing (and currently account for 50% of Micron’s storage business revenue, or $507 million) and the company continues to shift to high-value specialized NAND products from selling raw NAND chips, shipments of 3D XPoint are below expectations. According to Micron, it sold “very little” 3D XPoint memory to its unnamed parter (almost certainly Intel) during its Q3 FY2018.

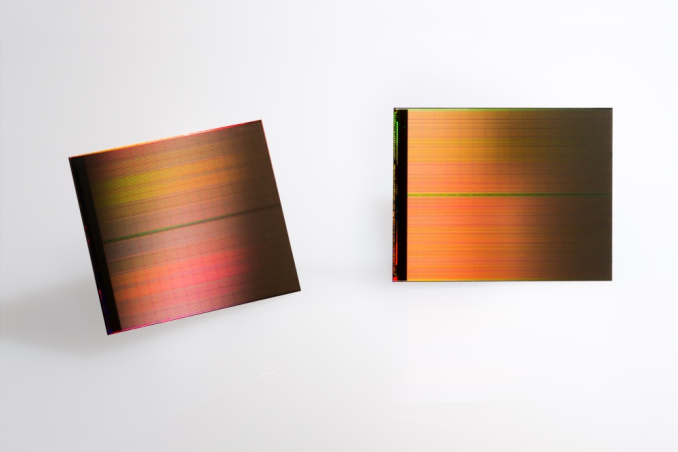

As our readers are well aware, 3D XPoint was jointly developed by Intel and Micron (IMFT). At present, this memory is produced exclusively at IMFT’s fab in Lehi, Utah, co-owned by Micron and Intel (who control 51% and 49% stakes, respectively). Late last year the two companies actually expanded the manufacturing complex with a new building called B60, which is equipped specifically to produce 3D XPoint. Meanwhile, the new type of memory is currently used only by Intel itself for Optane Memory caching SSDs aimed at mainstream PCs as well as Optane high-performance SSDs for servers and workstations. Micron is developing its own 3D XPoint-based products (which will be sold under the QuantX brand), but they are expected to launch only in late calendar 2019 with meaningful volumes/revenue sometime in 2020.

Since Micron does not consume any 3D XPoint for retail purposes, it needs to sell virtually all the output it has from the Lehi fab to Intel, otherwise Micron needs to register an underutilization charge (a fab that does not run wafers still costs a lot of money), which is exactly what happened last quarter. As it turns out, Intel is not consuming Micron’s entire share too, and the latter expects this situation to persist in the ongoing quarter, or even quarters. In fact, Micron even models a situation when Intel does not buy any of its 3D XPoint memory.

“The underutilization charge associated with 3D XPoint was about 700 basis points, as it hit to the SBU operating margins,” said Dave Zinsner, CFO of Micron. “We sold very little of 3D XPoint to our partner." “I think, longer term from underutilization perspective, we could continue to sell wafers to our partner, and that certainly would mitigate the underutilization charges.”

From Intel’s point of view, demand for 3D XPoint is actually higher than it can produce since it still needs to buy some wafers from Micron. Furthermore, as yields of 3D XPoint improve, Intel actually gets more good 3D XPoint dies from its 49% portion of the Lehi fab output. It is unknown whether Intel had actually planned to buy 3D XPoint memory from Micron, or if their original plans were to rely solely on their share and expecting Micron to use up their own share on their own products. Nonetheless, demand for the current Optane product lineup from Intel is only high enough to consume “Intel’s” memory and Micron does not expect demand to increase at least this quarter.

Demand for 3D XPoint from Intel may increase in the coming quarters because the company is gradually expanding its Optane lineup. In March the company demonstrated its Optane M.2 enterprise SSD, then in May it announced its Optane SSD 905P aimed at enthusiasts and featuring RGB lighting, then in late May the firm showcased its Optane DC Persistent Memory (Apache Pass) modules featuring 128 GB – 512 GB capacities and aimed at next-generation servers.

Once Intel launches these products and ramps up their production, it may need additional 128 Gb 3D XPoint memory chips to fulfill demand for these devices, and this is when Micron may get a bigger piece of the Optane pie. Meanwhile, it should be noted that the Optane M.2 and the Optane 905P are essentially niche products that may not get overly popular. By contrast, the Optane DC Persistent Memory requires validation and qualification from server OEMs (which may take some time) and then the ramp up of a new server platform will take several more quarters.

Micron is confident that there is a bright future ahead for 3D XPoint memory in general. However, at present it suffers from underutilization of its 3D XPoint production lines.

“We are excited about the potential for 3D XPoint technology to create a new tier of memory and storage between DRAM and NAND flash,” said Mr. Mehrotra.

Related Reading:

- Micron’s 96-Layer 3D TLC NAND Demonstrated, Qualified by Maxio, SMI

- Intel And Micron Launch First QLC NAND: Micron 5210 ION Enterprise SATA SSD

- Micron Starts Construction of Its Third NAND Fab in Singapore

- Micron Readies 3D QLC NAND-Based Datacenter SSDs for Nearline Storage

- Intel And Micron To Discontinue Flash Memory Partnership

Sources: Micron, SeekingAlpha, SemiWiki, SemiEngineering, The Memory Guy, Intel

30 Comments

View All Comments

PeachNCream - Saturday, June 23, 2018 - link

1000 P/E cycles, which is not currently attained in any of the few QLC NAND products on the market today, is extremely limited compared to the 100,000 P/E cycles attained by SLC NAND in the recent past. Granted capacity at reduced cost is a good thing, but much of the cost reductions between MLC and TLC were not passed on to consumers. The price decreases we've seen recently exhibit a more natural volume/supply ramp up versus demand rather than a significant stair-step as would be observed with the introduction of much increased capacity through a sudden increase in density.wr3zzz - Saturday, June 23, 2018 - link

Sounds like Intel and Micron co-own the fab but have exclusive control of their own lines. In that case I can see why Intel refrained from getting more wafers from Micron as they would run the risk of not able to secure supply once Micron launches its own 3D Xpoint products.Urthor - Saturday, June 23, 2018 - link

Why would they run seperate lines though? Wouldn't it make far more sense to have co-ownership of all the lines and an output agreement? Otherwise if each partner is implementing separate IP in separate lines, their co-op agreement is largely owning the same clean room infastructure with entirely different fabs side by side.FullmetalTitan - Saturday, June 23, 2018 - link

They just have wafer agreements that designate portions to each based on ownership of the fab (51/49 split). The processing paths are 100% identical and the products are matched, Intel just doesn't want to take the marginal profit loss by having to buy Micron's share and then resell itLolimaster - Saturday, June 23, 2018 - link

Instead of selling optane as cache they should focus the advertise for consumers to be used as a boot drive and for premium desktops.56-112GB for OS then another SSD/HDD included.

Urthor - Saturday, June 23, 2018 - link

That makes zero sense if you consider the overall positioning of the consumer market, the breakdown of the bill of materials and margins for laptops which make up the vast majority of consumer. Enterprise market's margins and overall gross size means that it's far more important than consumer, the consumer premium laptop/premium desktop market is miniscule.Lolimaster - Saturday, June 23, 2018 - link

Even at those low capacities the endurance should be at 1PB minimum, not a crappy 350TB.watzupken - Saturday, June 23, 2018 - link

I wonder if Intel is telling the truth or just painting a nice picture of 3D X-Point to their shareholders. They are almost like dumping it to OEMs just to increase sales. Its high power consumption makes higher capacity ones unsuitable for laptops anyway.Rudde - Saturday, June 23, 2018 - link

I do wonder if Micron will be using string stacking for their 4:th generation of nand. 192- or 256-layers nand would greatly increase ssd capacities.Arnulf - Tuesday, June 26, 2018 - link

"sales of its 3D XPoint memory were well below expectations"What are they saying? That people don't want to buy 18 GB SSDs in 2018? But ... 18 GB. In 2018? Geddit??

What DO these people want then, 2018 GB (~2 TB) SSDs ... or what ???