Intel 7nm Delayed By 6 Months; Company to Take “Pragmatic” Approach in Using Third-Party Fabs

by Ryan Smith on July 23, 2020 10:00 PM ESTWhile today second quarter earnings report from Intel represented a high-water mark for the company amid booming sales and revenues, unfortunately not everything disclosed today was good news from the company. As part of Intel’s quarterly earnings presentation, the company announced that their under-development 7nm manufacturing process has suffered a six month delay due to a defect in the process. As a result, the first consumer products aren’t due until at least late 2022, leaving Intel with 10nm as their best in-house manufacturing process for the next couple of years.

But even more important than that, the delay has spurred some soul searching within Intel, driving the company to pivot on its manufacturing plans and open the door to using third-party fabs for a much broader segment of its products. Going forward, the company will be taking what CEO Bob Swan and other leadership are calling a “pragmatic” approach, looking at both in-house and third-party fabs and using those fabs that make sense for the company and the product in question. And while the company has not announced any specific plans to outsource production – they are looking at it for products in the 2022-and-later timeframe – it would be hard to overstate how dramatic of a shift this is for the industry, and for a company that even five years ago was the world’s leader in silicon lithography manufacturing.

7nm Delayed By Six Months

But before we get too far into Intel’s future plans, let’s talk about the past and the present, and how those are driving Intel’s decision to look towards outside fabs. Ever since Intel’s 10nm process suffered repeated delays, Intel’s plan to get the company’s manufacturing side back on track was to nail the development of their 7nm process. The goal was to deliver 7nm on time – making up for the time lost from the 10nm delays – getting a solid process out that Intel could quickly ramp up, retaking the lead in the race to sustain Moore’s Law. A side-effect of this plan would have been that 10nm was to be a relatively short-lived process, allowing Intel to get off of the troubled process rather quickly and on to the more reliable 7nm process.

Unfortunately for Intel, developing their 7nm process has not gone to plan. As revealed in today’s call, 7nm yields are roughly a full year behind schedule – that is, Intel expects it to take another year to get yields to where they wanted them for Q2 of 2020. As a result, the company has needed to push back the bulk of its 7nm product schedule by 6 months. The first 7nm client CPUs are now not expected before late 2022 or early 2023. Meanwhile the first 7nm server part is not expected until the first half of 2023.

The only 7nm part that remains (roughly) on schedule at this point is Ponte Vecchio, Intel’s Xe-HPC GPU that will be going into the Aurora supercomputer. That is expected to ship in late 2021 or early 2022, and even then Intel is evaluating whether to move the manufacturing of some of Ponte Vecchio’s parts to third-party fabs.

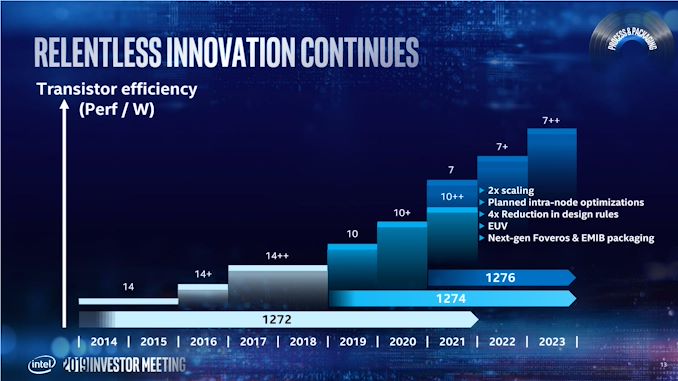

For Reference: Intel's Fab Schedule Circa May 2019

The good news, at least, is that despite all of this, Intel believes that they have a good grasp on the problem. With Swan describing the problem as a “defect mode” that was reducing yields, Intel has found the root cause of the issue and is moving to fix it, stating that that the company doesn’t believe that there are any fundamental roadblocks in their 7nm process. So as Intel’s current plans go, the company is still all-in on 7nm, and baring further issues, it’s going to become the cornerstone of their technology in 2023 when it begins volume shipping.

None the less, a six month delay is still a six month delay, and it comes at a time when Intel can ill afford it. Intel’s repeated 10nm problems set the company back years, and the ramifications to Intel’s product lines are ongoing as they continue to ship 14nm desktop and server processors. Meanwhile, though not wholly comparable in terms of node size, fab rival TSMC is set to start shipping 5nm parts this year, extending their lead over Intel and giving TSMC’s customers a leg-up in terms of things like power efficiency and die sizes. At the end of the day Intel has already been down this road once before with 10nm, and they’re intent on not repeating the same mistakes.

Being Pragmatic Means Knowing When to Yield

As a result of the 7nm delay, going forward Intel will be taking what Swan is calling a “pragmatic” approach in selecting what foundries to use. Intel will no longer be limiting themselves to near-exclusive use of their own fabs, and instead the company will be taking the capabilities (and costs) of third-party fabs into the equation. At the end of the day Intel still wants to produce market-leading chips, and they are now willing to use third-party fabs to accomplish this.

We will continue to invest in our future process technology roadmap, but we will be pragmatic and objective in deploying the process technology that delivers the most predictability and performance for our customers, whether that be our process, external foundry process or a combination of both.

-Intel CEO Bob Swan

While Intel isn’t committing to any specific manufacturing plans today, the message from Intel is clear: they will do what they need to in order to deliver new products according to their release roadmap. This means relying on third-party fabs as a contingency plan and leaving virtually every option on the table, including manufacturing a product entirely at a third-party fab if that is truly the best option. Ultimately, the question Intel is facing is how much should they rely on their 7nm fabs, and how much should they rely on third parties.

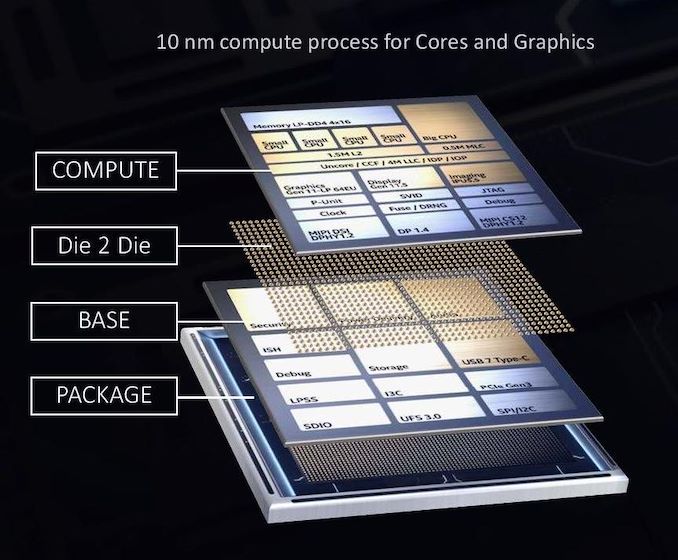

Meanwhile, underpinning this newfound philosophy of flexibility are Intel’s recent developments in what the company is terming “disaggregated die” technologies like EMIB and Foveros. These multi-chip packaging technologies, which have been rolled out in products like Kaby Lake-G and Intel’s new Core-L “Lakefield” processors, allow for multiple dissimilar dies to be used on a single package. In Lakefield’s case, that was accomplished by layering a 10nm compute die on top of a 22nm I/O die, allowing Intel to make the performance critical parts of the chip on the relatively expensive 10nm process, while non-critical parts were built on an extremely power efficient version of 22nm.

Lakefield, in turn, is the first of what will be many products from Intel using this technology. By gluing chips together Intel can not only better manage yield issues – defects are far less disruptive when they impact a small chiplet instead of a large monolithic die – but it means Intel can continue to mix-and-match different process nodes. And not just different Intel process nodes, but third-party process nodes as well.

We’ve already seen a very small taste of this with Kaby Lake-G, which used a GlobalFoundries-built GPU with an Intel-built CPU, albeit on a very coarse scale with minimal integration. But going forward intel’s flexibility plans mean they need to do it on a much larger and finer-grained scale. The upshot is that based on Lakefield there seems to be little doubt Intel can do this – which fab the chips come from shouldn’t have much of an impact on packaging – and instead it’s a question of how much of it Intel does. It’s clear that no matter what, Intel has to go the chiplet route for future products, as chiplets are what will enable Intel’s fab flexibility. But which of those chiplets will be Intel-made, and which of them will be made by third-party fabs? Intel will be spending the next couple of years figuring out just that.

Finally, it bears mentioning that none of this would even be possible without Intel’s other recent pivot towards divorcing product designs from process nodes. The company’s traditional vertically-integrated design philosophy has delivered a lot of excellent products over the years, but Intel has been feeling the pain of this decision since 10nm was delayed, and with it the use of their newer Sunny Cove CPU architecture. Intel has only recently gained the ability to port an architecture to multiple process nodes, and it’s clear they are going to be heavily relying on that ability as part of any third-party chipmaking.

But First, Ponte Vecchio

While the bulk of Intel’s announcement today deals with products set for the 2023 timeframe, the company has also publicly commented on what it means for their very first 7nm product, Ponte Vecchio. The Xe-HPC GPU is the flagship of Intel’s Xe GPU efforts, and Ponte Vecchio chips are a fundamental building block of the forthcoming Aurora Supercomputer. But even more importantly for Intel right now are delivery dates: Aurora is scheduled to be delivered in 2021, a year before Intel is set to deliver their first high-volume consumer 7nm parts. Ponte Vecchio is an extremely important product for Intel, and they only have a limited amount of time left to work on it.

As a result, Intel has confirmed that the company is also reevaluating what fabs are used for the various parts of Ponte. Curiously, Intel has stated that the chip was always going to use a mix of first-party and third-party fabs, though I wonder if Intel is being a bit fast & loose there by including the HBM memory (which Intel doesn’t produce) in that assessment. At any rate, even if you exclude the memory, that still leaves the I/O base die, the connectivity chips, and the GPU itself as separate dies, any of which could theoretically be shuffled off to a third party fab.

To be sure, like the other announcements today Intel is sharing their specific manufacturing plans – and it’s likely Intel hasn’t even made a final decision on where to make the various chips. But at the same time Intel is making it clear that they are considering all of their options. The Aurora supercomputer was already scrapped once (when it was planned to be a Xeon Phi system), so Uncle Sam is going to be eager to get his $500M supercomputer, and Intel in turn may need to swallow some of its pride to make it happen.

Many Unknowns, but Intel’s Transformation Is Certain

Wrapping things up, while there are a lot of unknowns and things left to be determined in Intel’s plan, there is one thing that is certain: no matter what happens, Intel will be transforming. At a minimum they will be transforming from a company that relies on monolithic dies to a company that embraces multi-chip packages, and depending on how things go with 7nm, they may also be transforming into a company that farms out much of its chip production to third parties. This is nothing short of a remarkable change for a company that ruled the world of chipmaking not even half a decade ago.

But it’s a remarkable change that needs to happen. Though undoubtedly a hard pill for Intel to swallow, Intel’s 7nm delay poses a significant risk to a company that is already bracing for hard times from their 10nm delay. So something needed to change, if only so that Intel has a contingency plan in place should 7nm slip yet again.

At the end of the day what happens next is still up in the air. Intel has decisions to make, and perhaps most importantly of all, Intel’s process technology team is facing a do-or-die situation with 7nm. Intel has invested a great deal in their 7nm process, and for both profit and product reasons, they would certainly prefer to use that. This means that if Intel can keep 7nm on track, then what is now just a contingency plan will likely remain just that.

But regardless of what happens, it’s clear that Intel can no longer bet the house on themselves. Silicon lithography is only getting harder, and a very mortal Intel has to prepare for the possibility that it's a race they may not win.

208 Comments

View All Comments

way2funni - Saturday, July 25, 2020 - link

This whole article reads like a 'really bad news media management' situation.They are giving you a heads up on bad news (6 month delay) which nobody believes because after the 14nm desktop cycle that has lasted SIX YEARS ALREADY and intel is still not expected to drop a desktop 10nm CPU until H2 of 2021.

IMHO they need at least a year or two to monetize 10nm on desktop node and get the revenue out before moving on - they can't just write it off after all this , rake the hit and jump straight to 7nm amirite?

Then they leave the door open and essentially ANSWER the unspoken question hanging in the air "well, 6 months is fine - the economy is ficked anyway - but what if you DON'T make it and it ends up being SIX YEARS AGAIN?

I dunno, maybe intel figures evan at single digit yields, the big server chips that retail 5k and up can still be profitable on 7nm.

Then mobile. if 10nm on desktop arrives by H2' 21 , they can push 7nm desktop to H2 2023 which accomplishes all the goals. UNless AMD eats any more share (which they will)

They may be figuring if AMD can execute on desktop via 3rd party fabs, so can they, but I dunno if I see intel opening up their IP portfolio to 3rd party fabs. The ip they have locked up under patent may be the only ace they have going forward but if they can still use their own fabs to make the chips that make the big servers go and then all the mobile stuff that still has a healthy margin, and farm out the less profitable stuff, even if they continue fucking up their nobes and yields, they may survive the 2020's.

Santoval - Saturday, July 25, 2020 - link

"I dunno, maybe intel figures evan at single digit yields, the big server chips that retail 5k and up can still be profitable on 7nm."Do they really have single digit yields? I thought, at an absolute worst, they had low double digits. I suppose you refer to yields of large Ice Lake-SP dies, not small Ice/Tiger Lake ones, right?

So they have seen no yield improvements from the latest iteration of their 10nm+ node variant which they are fabbing Tiger Lake with and whichever 10nm+ variant they are using to fab Ice Lake-SP, and just *hope* things will be fixed (somehow) with their 10nm++ variant for Alder Lake? Yeah, good luck with that. The low yields of Ice Lake-SP can be tolerated due to their obscene prices, but the same does not apply to Ice & Tiger Lake, hence Comet & Rocket Lake, respectively. As far as I know though they are not planning a dual node release of Alder Lake with yet another tortured 14nm node part.

Santoval - Saturday, July 25, 2020 - link

It took a little while but the first completely non unexpected delay of Intel's 7nm node was announced. And I am certain it is only the first one. How much delay are Intel going to face in total? I bet a system based on a 16-core Ocean Cove-S fabbed at TSMC's 3/4nm node (:p) that it's going to be 3 x 6 months, i.e. a delay of an extra 12 months or 18 months in total. So, mark my words and prepare monies for that Ocean Cove system (with at least 64 GB of DDR5 please) : the first product fabbed on Intel's 7nm node is not going to be released before Q4 2023 - Q1 2024. To be more specific let's say December 2023, a few weeks before Christmas*. With the possible exception of Ponte Vecchio, since yields for a $500 million supercomputer are much less of an issue.*In low-ish, Ice Lake - level volume, along with some 10nm part which will comprise the bulk of the release. In high volume not before Q2 2024.

aperson2437 - Saturday, July 25, 2020 - link

Maybe Intel should just focus on getting to 3nm using EUV lithography. I suspect that TSMC might shock everyone and they'll be selling industry leading 3nm chips in 2021. The Apple A14 chip for the upcoming iPhone 12 this year will have TSMC 5 nm chip technology. Intel better put the pedal to the metal. Google this ... TSMC 3nm 'risk production' in 2021 paves the way to 2022 mass productionAnGe85 - Monday, July 27, 2020 - link

Currently, TSMCs roadmap for 3nm ist HVM in 2HY22, meaning smartphone SoCs (small chips), meaning no x86-CPUs until 2023. Additionally you can expect something like a 5nm-Zen at the earliest in 2HY23, because Zen4 is scheduled for 2022 and for example Epyc will be launched over various models throughout the whole year, so it is unlikely to see 5nm from AMD already early 2023.Additionally Intel has shifted Granite Rapids SP (7nm+) to 1HY23 and stated, that the first 7nm-CPU will be a client CPU, meaning this has to arrive considerably before Granite Rapids SP, so the first 7nm-CPU from Intel could appear by the end of 2022 (I would guess it will be a mobile chip rather than a desktop chip).

AnGe85 - Monday, July 27, 2020 - link

Correction: "like a 5nm-Zen" should have been a "3nm-Zen"Vitor - Sunday, July 26, 2020 - link

By the time their 7nm get in the market, Apple will have their 3rd gen of desktop chips made in 3nm.I feel the sun is setting for Intel, even if slowly like a long summer day.

ijdat - Sunday, July 26, 2020 - link

Spending a fortune on your own fab works so long as the savings on wafer prices outweigh the cost of the fab, and your process is either better than the foundries or at least as good.The problem for Intel is that the cost of building a bleeding-edge fab has been rising exponentially -- much faster than their overall sales -- so the first condition no longer applies. The second one is gone -- at 22nm they were first to FinFET (better than the foundries), 14nm was pretty good (and optimised for CPUs), but 10nm was an over-ambitious car crash and doesn't give them a solid foundation to build 7nm on -- which was late anyway compared to TSMC 5nm, and is now even later, assuming Intel can get it to yield resonably quickly like they didn't with 10nm. Meanwhile TSMC use the entire world's chip sales to pay for their R&D and fabs, and by doing "baby-steps" have already ended up ahead of Intel, and are pulling further ahead month by month.

All this makes it well-nigh impossible for Intel to catch up on process technology in the short-term, which in turn makes it completely impossible in the long-term -- they've fallen behind and there's no way to fix this. The only thing they can do that might work is to divert all their huge process R&D expenditure into chip R&D and try and overtake AMD (and others) that way -- in other words, acknowledge defeat on the process front and pull out, and try and win on IC design (which they're perfectly capable of doing without the process millstone round their neck).

Unfortunately this would mean such a massive loss of face -- admitting that their "world's best process" strategy was dead -- that I doubt if Intel management has got big enough balls to do it.

On another subject, there's now only one 5nm process at TSMC, N5+ (improved performance, same design rules) has been effectively renamed N5, that's all that the fabs are making from now on.

Duncan Macdonald - Sunday, July 26, 2020 - link

The statement by Intel could have been more accurately put as "When Intel was ahead of AMD, its management became complacent and did not press its R&D for several years. When AMD came out with its Ryzen chips the management had no good way to respond. Intel's multiyear inertia has left AMD on a more advanced manufacturing node (and about to transition to a yet more advanced one) and it will take Intel years to catch up to AMD. Before that happens much of the customer base is likely to move to AMD from Intel. Expect profits to decline for the next several years."Igor_Kavinski - Monday, July 27, 2020 - link

Look. Let's stop beating about the bush. What's the real source of the problem at Intel? When did all these process manufacturing troubles start? Who are the incompetent people who failed to execute their plans and have been giving nothing but excuses for the past few years now? Intel shareholders need to take action now before it's too late. Get rid of the problematic people ASAP before the cancer grows even more and metastasizes. Search out the tumors and give them the boot in the most unceremonious way, because that is what they deserve for taking their salaries and bonuses and still failing to keep up with their promises. This isn't a joke anymore.