Intel Announces Ohio Fab Complex: 2 New Fabs For $20B, And Space For More

by Ryan Smith on January 21, 2022 1:00 PM EST

With fab expansions on tap across the entire semiconductor industry, Intel today is laying out their own plans for significantly increasing their production capacity by announcing their intention to build a new $20 billion fab complex in Ohio. With the paperwork already inked and construction set to begin in late 2022, Intel will be building two new leading-edge fabs in their new Ohio location to support future chip needs. And should further demand call for it, the Ohio complex has space to house several more fabs.

Intel’s announcement follows ongoing concerns about chip fab capacity and national security, as like other chip fabs, Intel is looking to expand their capacity in future years amidst the current chip crunch. All the while, the United States government has become increasingly mindful about how much chip production takes place in geopolitically tricky Taiwan, placing additional pressure on firms to build additional fabs within the US. To that end, Intel has been not-so-secretly undertaking a search to find a good location for a new fab campus, and they have finally found their answer in Ohio.

The new site, Intel’s first new manufacturing site location in 40 years, is located in New Albany, Ohio, just outside of Columbus. Up until now, all of Intel’s major chip fab sites have been in the western United States – Oregon, Arizona, and at one point, Silicon Valley – so the Ohio site is a significant move for the company. All told, the Ohio “mega-site”, as Intel likes to call it, covers nearly 1000 acres. And while Intel is only initially planning for two fabs, the site offers plenty of room to grow, offering enough space for a total of 8 fabs.

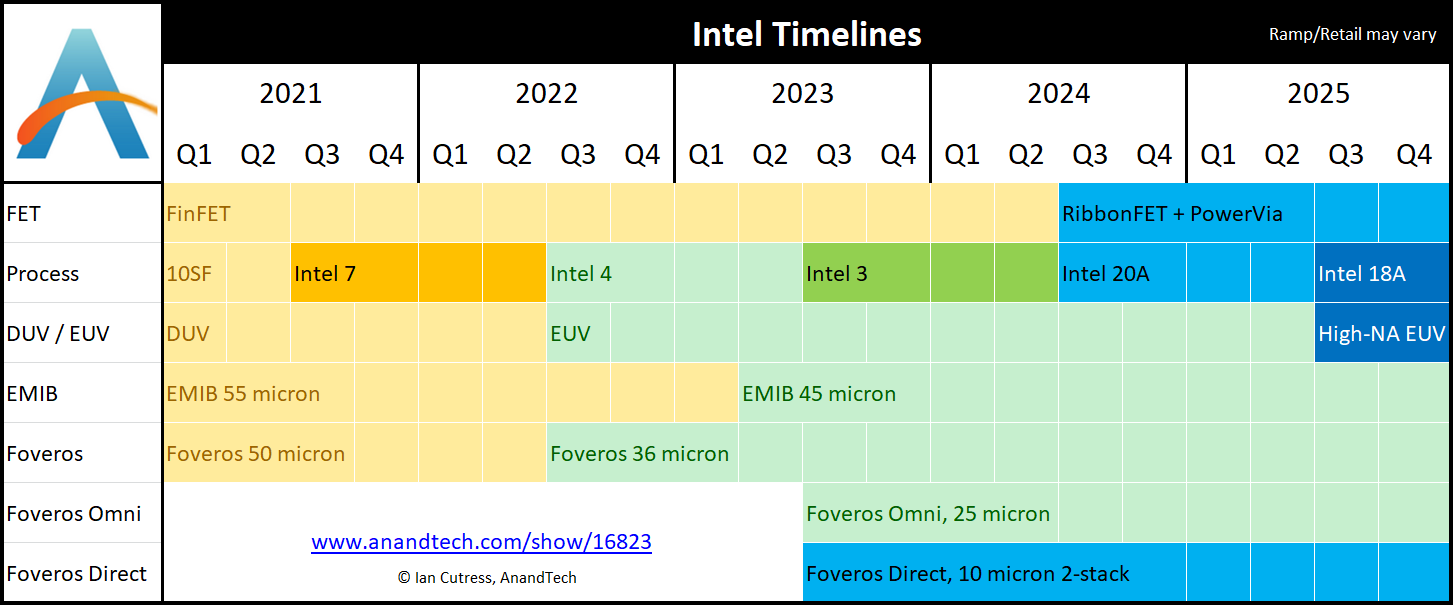

The immediate goal of the company – and the crux of today’s announcement – revolves around the building of two new leading-edge fabs at the Ohio location. According to Intel, these two fabs will begin construction late this year, with production coming online in 2025. The company isn’t formally stating what the initial process node will be – instead saying that it will be using the "industry's most advanced transistor technologies" – however if the company is indeed building truly bleeding-edge fabs, then 2025 lines up with Intel’s 18A process, which will be 4 generations newer than what Intel is using now (Intel 7).

Altogether, Intel expects the project to cost about $20 billion, which is similar to what Intel will be spending for its two new Arizona fabs, which were announced just under a year ago. And further down the line, should Intel opt to fill the rest of the property with the other 6 fabs that the site can support, the company expects that the total price tag could reach nearly $100 billion. Ultimately, the company is making it clear that they are priming the site not just to met their mid-term production needs with the initial two fabs, but are making sure to have the space ready for further capacity expansion over the long-term.

As to whether Intel eventually builds those further 6 fabs, that will depend on a few factors. Key among these will be demand from Intel Foundry Services clients; while Intel will be using some of the Ohio site’s capacity for their own needs, the site will also be used to fab chips for IFS customers. If Intel’s bid to break into the contract fab business is successful, and the company is able to woo over additional clients/orders, then they will need to build additional fabs to meet that demand.

Also hanging in the balance is what the US Government opts for, both in terms of orders and incentives. The Ohio fabs will be used for domestic production of sensitive chips, as the US looks to secure its supply lines. Meanwhile the CHIPS for America Act and its 53 billion in incentives will also be a. Intel for its part isn’t playing coy about its interest in the CHIPS money, explicitly stating that “The scope and pace of Intel’s expansion in Ohio, however, will depend heavily on funding from the CHIPS Act”. In some respects Intel is taking a bit of a gamble by investing in the Ohio location before any CHIPS funding is approved – on a pure cost basis, overseas production is traditionally cheaper – so there is certainly a political element in announcing these fabs and selecting an Ohio location. And as an added incentive to the US Government, Pat Gelsinger has told Time that Intel would even be interested in bringing some chip packaging, assembly, and testing back to the US if the CHIPS Act were funded, which in turn would allow Intel to do every last step of production within the US.

But more immediately, Intel’s focus is on getting its first two Ohio fabs up and running. Along with building the facilities they’ll need a workforce to operate them, and as a result the company is also pledging $100M over a decade in funding for local educational efforts. As with similar local industry efforts, that investment would be focused on helping local colleges and universities establish semiconductor manufacturing curricula to help train the technical workforce required.

And while outside of Intel’s own investment scope, the creation of their Ohio fab complex means that Intel’s suppliers are also coming along for the ride. According to the company, Air Products, Applied Materials, LAM Research and Ultra Clean Technology have all indicated that they’ll be setting up facilities in the area. All of which the company is using to further underscore the size of the project and the value it brings to the area – and why they deserve that CHIPS Act funding.

Ultimately, the addition of a third US fab site and two more fabs to Intel’s portfolio is the latest step Intel has taken under Pat Gelsinger’s IDM 2.0 strategy. Gelsinger opted to go all-in on having Intel fab chips for themselves and others, and this is the kind of expansion that Gelsinger has been alluding to as necessary to make IDM 2.0 a reality. Taken altogether, Intel now has 4 leading-edge fabs set to come online in the 2024-2025 timeframe, and with any luck on Intel’s part, there will be room for several more to come.

Source: Intel

112 Comments

View All Comments

mode_13h - Sunday, January 23, 2022 - link

The lie that windmills caused Texas' power crisis of last winter has been quite thoroughly debunked. Sure, they didn't help, but the grid still would've collapsed even without the windmills freezing up.vlad42 - Sunday, January 23, 2022 - link

They were both cheap and stupid - what happened last winter has happened before. It was just deemed not worth it to winterize the infrastructure. Now, semiconductor manufacturers are looking to other states because up time is too important to chance.This is why most companies are looking at states like Ohio and New York. The power is reliable, there is plenty of water, and there are no fires/hurricanes/major natural disasters.

Gc - Friday, January 21, 2022 - link

How much power does a fab need?eia.gov ohio map shows two large powerplants to the east.

780-840MW Conesville plant (conventional steam COAL), with mines to the southeast.

540-678MW Dresden plant (Natural GAS)

also a battery facility

4 MW Sunbury facility

and even a solar array nearby

1.9MW Denison solar array

edzieba - Saturday, January 22, 2022 - link

"How much power does a fab need?"100 MW would not be uncommon.

IBM760XL - Friday, February 4, 2022 - link

The last of Conesville was decommissioned due to no longer being economically viable in 2019 and 2020, and was demolished in December. It's gone for good.Columbus voters approved a measure to transition to 100% renewable energy by default in 2020, and construction on those plants should be underway before long if it isn't already. Which means there should be plenty of excess capacity in the are for Intel as demand for the existing non-renewable plants decreases.

mode_13h - Saturday, January 22, 2022 - link

> The benefit of sticking to the west coast is no snow or> other weather related issues that may cause delays.

Until the heat dome of 2021, I'd have believed that about pacific northwest. Not any more. Weather is a potential issue *everywhere*. Heat waves, blizzards, hurricanes, tornados, flooding (like the "bomb cyclone" they had in Iowa)... you can't run or hide from it, any more.

Alistair - Sunday, January 23, 2022 - link

lol, relaxunderspec - Sunday, January 23, 2022 - link

"This is fine."IBM760XL - Friday, February 4, 2022 - link

I live about 20 miles from the site. Infrastructure keeps working in the winter in Ohio. We learned from our outage events in the mid-late 2000s, invested in the grid, and it's quite stable now. We just had a big freezing rain storm, and the power stayed on. In 2005, it might not have, but now it does.Texas just hoped it would never get cold because they're Texas and got burned when it did. We know it's going to get cold up here so we prepare for it. The last time it was 20 below zero Fahrenheit? The lights stayed on then, too, and so did the natural gas. You build the infrastructure to handle it because people would die if you didn't. Unless you're Texas, then you just pray that it never gets cold.

IBM760XL - Friday, February 4, 2022 - link

Ohio is also pretty great in terms of other weather factors. Essentially zero risk of flooding unless you build right by one of the main rivers. No wildfires. No hurricanes. No earthquakes. Plentiful water. Southwest Ohio has a few tornadoes, but Columbus is outside of Tornado Alley, and Intel's on the side that's farther yet from Tornado Alley.One large local company was looking for a site to build a new datacenter a decade or so ago, and initially wanted to build it somewhere other than Columbus to have geographic diversity. But what they found in the end was that the risk factors were so low, that there wasn't much point in building a long ways away. So they built their next data center in New Albany, exactly where Intel is building.