Intel Announces Q1 FY 2018 Results: Another Record

by Brett Howse on April 26, 2018 11:45 PM EST- Posted in

- CPUs

- Intel

- Financial Results

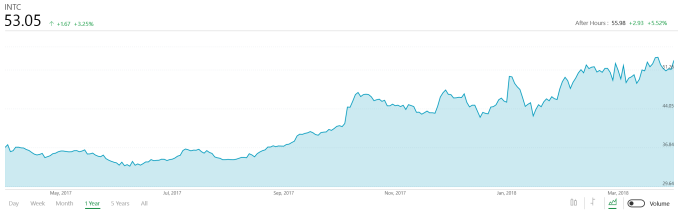

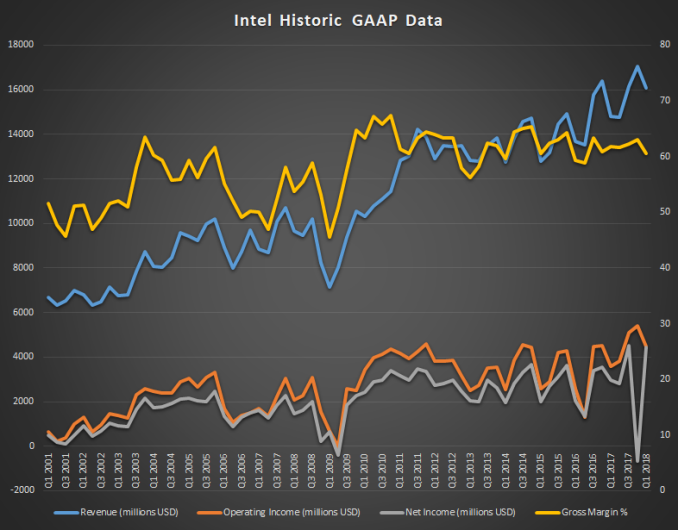

This afternoon, Intel announced their earnings for the first quarter of their 2018 fiscal year, and once again, the company has set new records, with revenue for the quarter of $16.1 billion, up 9% from a year ago. Intel is always a company built on strong margins, and although they were down 1.3% from last year, at 60.6% they are still quite strong. Operating income was up 23% to $4.5 billion, and net income was up 50% to $4.5 billion, which is the same as their operating income because they had gains on equity of $643 million, and they paid only 11.1% in taxes for the quarter. Earnings per share came in at $0.93, up 53%.

With numbers like that, it shouldn’t be a surprise that all of Intel’s business units improved their revenue year-over-year, including the Client Computing Group, which had revenues of $8.2 billion for the quarter, which was up 3%. It’s not a huge gain, but in a shrinking PC market, and stronger competition, they were able to scratch out some growth.

| Intel Q1 2018 Financial Results (GAAP) | |||||

| Q1'2018 | Q4'2017 | Q1'2017 | |||

| Revenue | $16.1B | $17.1B | $14.8B | ||

| Operating Income | $4.5B | $5.4B | $4.5B | ||

| Net Income | $4.5B | -$0.7B | $3.0B | ||

| Gross Margin | 60.6% | 63.1% | 61.9% | ||

| Client Computing Group Revenue | $9.0B | -8.9% | +3% | ||

| Data Center Group Revenue | $5.2B | -4.4% | +24% | ||

| Internet of Things Revenue | $840M | +3.5% | +17% | ||

| Non-Volatile Memory Solutions Group | $1B | +12.5% | +20% | ||

| Programmable Solutions Group | $498M | -12.3% | +17% | ||

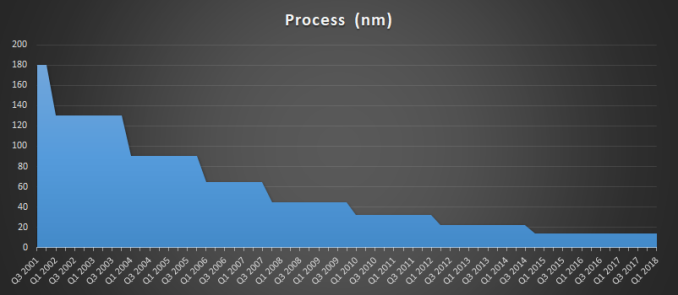

Ryan’s going to go more into this in another piece, but Intel also made it official that they are not going to have any volume shipments of 10 nm until 2019. Intel is currently shipping low-volume on 10 nm, but continued struggles in getting the new process up to speed mean that any 10 nm products that were in the works are now going to be delayed again. Intel is going to continue to improve their 14 nm node for this year.

Intel classifies the Client Computing Group as “PC-Centric” and you can see that it’s still the bread and butter of their revenue, but it’s also been stagnant for a while. They classify all of their other business as “Data-Centric” which includes the Data Center Group, IoT group, Non-Volatile Storage, Programable Solutions Group. This Data-Centric aspect is why Intel is growing again.

The Data Center Group had revenues of $5.2 billion, which is up 24% year-over-year. As we saw in AMD’s earnings, EPYC hasn’t really made an impact on their earnings yet, but Intel continues to dominate in this segment.

IoT is closing in on the billion-dollar revenue for a quarter, with growth of 17% year-over-year to $840 million. Although Intel missed out on mobile, IoT has the potential to quickly surpass mobile, and they’ve committed to this space early, and are seeing strong growth.

Non-Volatile Memory Solutions, which is Intel’s NAND flash and Optane group, had revenues of $1.0 billion for the quarter, which is up 20% year-over-year. They’ve focused a lot on the datacenter with their solutions, and there is higher margins there, so it’s not a surprise to see them focus in on that market.

Programmable Solutions had revenues of $498 million for the quarter, up 17% year-over-year. This is another strong growth segment for Intel, and we’ve seen a lot of the cloud infrastructure trying to find ways to offload work onto FPGAs in an attempt for more efficient workloads.

Thanks to the strong start, Intel has already raised their full-year expectations to $67.5 billion, which is an increase of $2.5 billion over their last forecast. Intel has traditionally led with their fabs, so it’s interesting to see them growing with such vigour when their fabs advances are completely stalled, but such is the growth of cloud computing.

Source: Intel Investor Relations

17 Comments

View All Comments

HStewart - Thursday, April 26, 2018 - link

So what this tells me is that Meltdown/Spectre stuff and Ryzen did not mean anything to Intel bottom line. Also they were smart in stop products that did not make run.sgeocla - Friday, April 27, 2018 - link

Most consumers don't really know or care about the performance loss since some of the patches arrived in february and then retracted and then new patches, and so on until april. So alot of confusion and q1 cannot reveal anything about that.Intel announced datacenter sales slowdown and that is where the security issues will hurt the most as customers cannot allow the servers unpatched and must replace a lot of their older hardware that is most severely afftected by the patches. Also q1 cannot account for that as large orders take months for delivery. Since datacenter is growing more than 20% YoY and EU and China announcing accelerated datacenter pickup a slowdown for Intel is pretty revealing.

Krysto - Friday, April 27, 2018 - link

Don't trivialize the issue. Otherwise the next time they may not even care about fixing such an issue, and we'll all be worse off.95% of Intel consumers don't even know what Meltdown and Spectre are.

Drumsticks - Friday, April 27, 2018 - link

Almost all of their growth came outside of consumer CPUs. I'm not sure why that would lead to the conclusion that Ryzen had no impact.jjj - Friday, April 27, 2018 - link

"Although Intel missed out on mobile, IoT has the potential to quickly surpass mobile, and they’ve committed to this space early, and are seeing strong growth."That's funny, Intel's IoT is the misleading way to label embedded. There is some IoT there and Mobileye but Intel is not really playing in IoT. IoT is too competitive and low ASP for them.Worse, they don't have the expertise or the distribution channel.

sgeocla - Friday, April 27, 2018 - link

They just announced cutting off the wearables 'limb' and a lot of earlier IoT chips have been discontinued over the years.I agree, this is just Intel moving other business into what has traditionally been IoT to appear they are growing their TAM.

IoT much hype, embedded very old grandpa tech. /s

Vlad_Da_Great - Friday, April 27, 2018 - link

Misleading for those with a fish size brain. IoT is the whole eco system. Intel does now around 70%(+-5) of that revenue out of services.jjj - Friday, April 27, 2018 - link

LOL what are you smoking?We already know what you are eating and for that, you win the "Trump of the Month" and a toilet brush for your mouth!

For the sake of other readers that might be curious how Intel defines their IoT segment:

"IOTG develops and sells high-performance Internet of Things compute solutions for retail, automotive, industrial, and video surveillance market segments, along with a broad range of other embedded applications. These market-driven solutions utilize silicon and software assets from our data center and client businesses to expand our compute footprint into Internet of Things market segments. "

BillBear - Friday, April 27, 2018 - link

Tick, Tock, Thwack, Thunk, Thud?shabby - Friday, April 27, 2018 - link

Thop!